HFG Mobile Money Activity: Profiling examples of mobile money in health

The HFG Mobile Money activity is tracking the uptake of mobile money in health — documenting experiences and lessons learned and identifying emerging trends and promising practices. The map below shows the mobile money applications we are currently following. The tracker will be updated on a regular basis. We are also creating program profiles for each of these activities with completed profiles are listed below.

If you are using mobile money in your health program, please contact us here to be to share your experience.

HFG Mobile Money Tracker

Case Studies

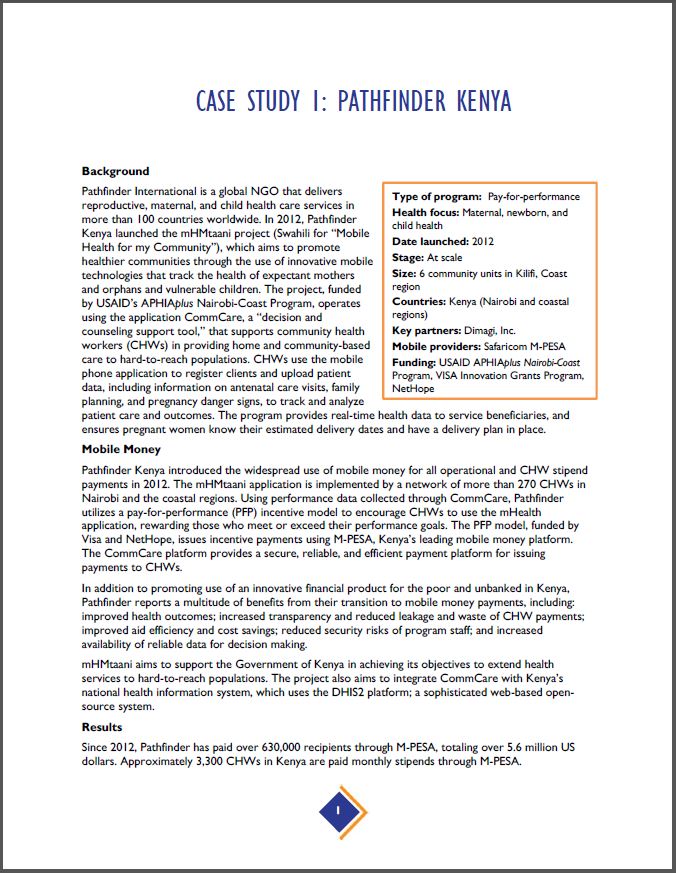

Pathfinder Kenya

In 2012, Pathfinder Kenya launched the mHMtaani project (Swahili for “Mobile Health for my Community”), which aims to promote healthier communities through the use of innovative mobile technologies that track the health of expectant mothers and orphans and vulnerable children. The project, funded by USAID’s APHIAplus Nairobi-Coast Program, operates using the application CommCare, a “decision and counseling support tool,” that supports community health workers (CHWs) in providing home and community-based care to hard-to-reach populations. CHWs use the mobile phone application to register clients and upload patient data, including information on antenatal care visits, family planning, and pregnancy danger signs, to track and analyze patient care and outcomes. The program provides real-time health data to service beneficiaries, and ensures pregnant women know their estimated delivery dates and have a delivery plan in place. Read more…

In 2012, Pathfinder Kenya launched the mHMtaani project (Swahili for “Mobile Health for my Community”), which aims to promote healthier communities through the use of innovative mobile technologies that track the health of expectant mothers and orphans and vulnerable children. The project, funded by USAID’s APHIAplus Nairobi-Coast Program, operates using the application CommCare, a “decision and counseling support tool,” that supports community health workers (CHWs) in providing home and community-based care to hard-to-reach populations. CHWs use the mobile phone application to register clients and upload patient data, including information on antenatal care visits, family planning, and pregnancy danger signs, to track and analyze patient care and outcomes. The program provides real-time health data to service beneficiaries, and ensures pregnant women know their estimated delivery dates and have a delivery plan in place. Read more…

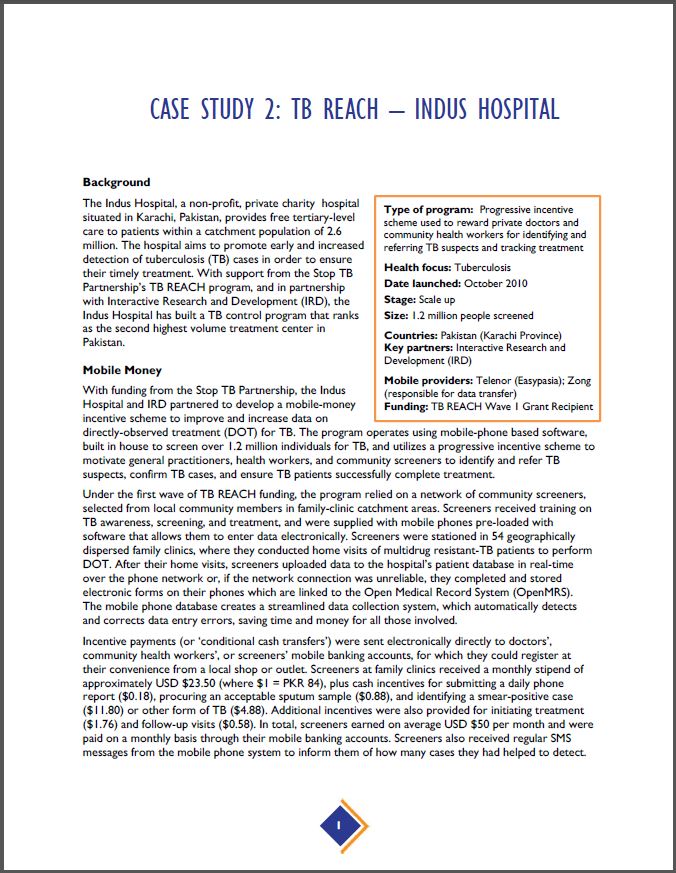

TB REACH – Indus Hospital

The Indus Hospital, a non-profit, private charity hospital situated in Karachi, Pakistan, provides free tertiary-level care to patients within a catchment population of 2.6 million. The hospital aims to promote early and increased detection of tuberculosis (TB) cases in order to ensure their timely treatment. With support from the Stop TB Partnership’s TB REACH program, and in partnership with Interactive Research and Development (IRD), the Indus Hospital has built a TB control program that ranks as the second highest volume treatment center in Pakistan. With funding from the Stop TB Partnership, the Indus Hospital and IRD partnered to develop a mobile-money incentive scheme to improve and increase data on directly-observed treatment (DOT) for TB. The program operates using mobile-phone based software, built in house to screen over 1.2 million individuals for TB, and utilizes a progressive incentive scheme to motivate general practitioners, health workers, and community screeners to identify and refer TB suspects, confirm TB cases, and ensure TB patients successfully complete treatment. Read more…

The Indus Hospital, a non-profit, private charity hospital situated in Karachi, Pakistan, provides free tertiary-level care to patients within a catchment population of 2.6 million. The hospital aims to promote early and increased detection of tuberculosis (TB) cases in order to ensure their timely treatment. With support from the Stop TB Partnership’s TB REACH program, and in partnership with Interactive Research and Development (IRD), the Indus Hospital has built a TB control program that ranks as the second highest volume treatment center in Pakistan. With funding from the Stop TB Partnership, the Indus Hospital and IRD partnered to develop a mobile-money incentive scheme to improve and increase data on directly-observed treatment (DOT) for TB. The program operates using mobile-phone based software, built in house to screen over 1.2 million individuals for TB, and utilizes a progressive incentive scheme to motivate general practitioners, health workers, and community screeners to identify and refer TB suspects, confirm TB cases, and ensure TB patients successfully complete treatment. Read more…

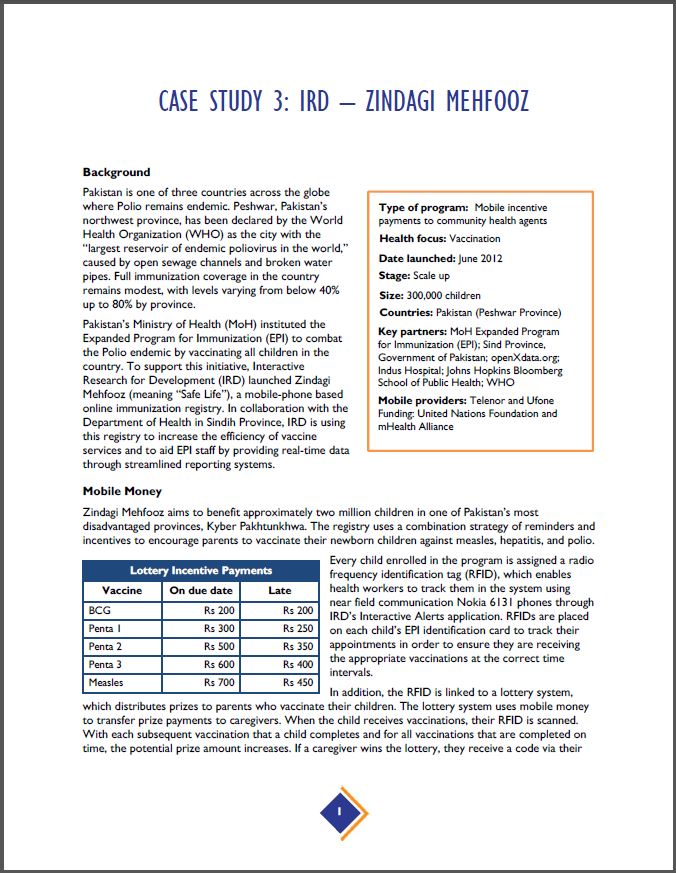

IRD – Zindagi Mehfooz

Pakistan’s Ministry of Health (MoH) instituted the Expanded Program for Immunization (EPI) to combat the Polio endemic by vaccinating all children in the country. To support this initiative, Interactive Research for Development (IRD) launched Zindagi Mehfooz (meaning “Safe Life”), a mobile-phone based online immunization registry. In collaboration with the Department of Health in Sindih Province, IRD is using this registry to increase the efficiency of vaccine services and to aid EPI staff by providing real-time data through streamlined reporting systems. Zindagi Mehfooz aims to benefit approximately two million children in one of Pakistan’s most disadvantaged provinces, Kyber Pakhtunkhwa. The registry uses a combination strategy of reminders and incentives to encourage parents to vaccinate their newborn children against measles, hepatitis, and polio. Read more…

Pakistan’s Ministry of Health (MoH) instituted the Expanded Program for Immunization (EPI) to combat the Polio endemic by vaccinating all children in the country. To support this initiative, Interactive Research for Development (IRD) launched Zindagi Mehfooz (meaning “Safe Life”), a mobile-phone based online immunization registry. In collaboration with the Department of Health in Sindih Province, IRD is using this registry to increase the efficiency of vaccine services and to aid EPI staff by providing real-time data through streamlined reporting systems. Zindagi Mehfooz aims to benefit approximately two million children in one of Pakistan’s most disadvantaged provinces, Kyber Pakhtunkhwa. The registry uses a combination strategy of reminders and incentives to encourage parents to vaccinate their newborn children against measles, hepatitis, and polio. Read more…

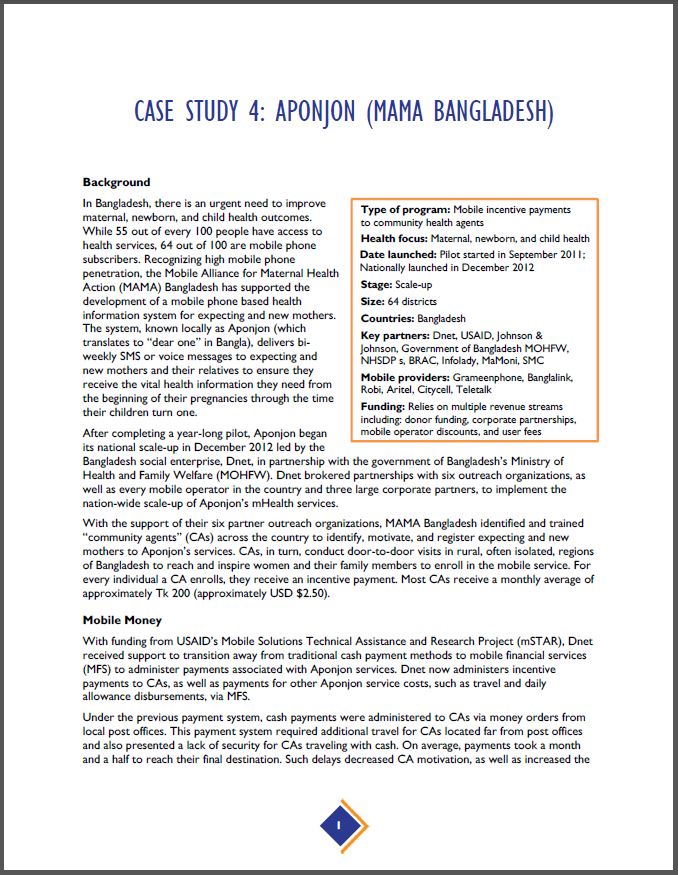

Aponjon (MAMA Bangladesh)

In Bangladesh, there is an urgent need to improve maternal, newborn, and child health outcomes. While 55 out of every 100 people have access to health services, 64 out of 100 are mobile phone subscribers. Recognizing high mobile phone penetration, the Mobile Alliance for Maternal Health Action (MAMA) Bangladesh has supported the development of a mobile phone based health information system for expecting and new mothers. The system, known locally as Aponjon (which translates to “dear one” in Bangla), delivers biweekly SMS or voice messages to expecting and new mothers and their relatives to ensure they receive the vital health information they need from the beginning of their pregnancies through the time their children turn one. After completing a year-long pilot, Aponjon began its national scale-up in December 2012 led by the Bangladesh social enterprise, Dnet, in partnership with the government of Bangladesh’s Ministry of Health and Family Welfare (MOHFW). Read more…

In Bangladesh, there is an urgent need to improve maternal, newborn, and child health outcomes. While 55 out of every 100 people have access to health services, 64 out of 100 are mobile phone subscribers. Recognizing high mobile phone penetration, the Mobile Alliance for Maternal Health Action (MAMA) Bangladesh has supported the development of a mobile phone based health information system for expecting and new mothers. The system, known locally as Aponjon (which translates to “dear one” in Bangla), delivers biweekly SMS or voice messages to expecting and new mothers and their relatives to ensure they receive the vital health information they need from the beginning of their pregnancies through the time their children turn one. After completing a year-long pilot, Aponjon began its national scale-up in December 2012 led by the Bangladesh social enterprise, Dnet, in partnership with the government of Bangladesh’s Ministry of Health and Family Welfare (MOHFW). Read more…

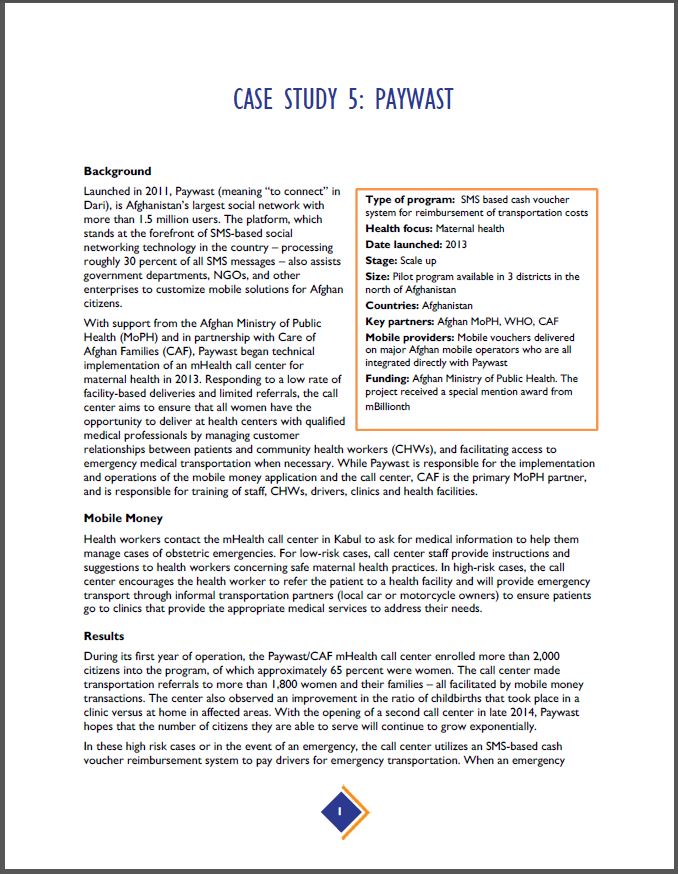

Paywast (Afghanistan)

Launched in 2011, Paywast (meaning “to connect” in Dari), is Afghanistan’s largest social network with more than 1.5 million users. The platform, which stands at the forefront of SMS-based social networking technology in the country – processing roughly 30 percent of all SMS messages – also assists government departments, NGOs, and other enterprises to customize mobile solutions for Afghan citizens. With support from the Afghan Ministry of Public Health (MoPH) and in partnership with Care of Afghan Families (CAF), Paywast began technical implementation of an mHealth call center for maternal health in 2013. Responding to a low rate of facility-based deliveries and limited referrals, the call center aims to ensure that all women have the opportunity to deliver at health centers with qualified medical professionals by managing customer relationships between patients and community health workers (CHWs), and facilitating access to emergency medical transportation when necessary. Read more…

Launched in 2011, Paywast (meaning “to connect” in Dari), is Afghanistan’s largest social network with more than 1.5 million users. The platform, which stands at the forefront of SMS-based social networking technology in the country – processing roughly 30 percent of all SMS messages – also assists government departments, NGOs, and other enterprises to customize mobile solutions for Afghan citizens. With support from the Afghan Ministry of Public Health (MoPH) and in partnership with Care of Afghan Families (CAF), Paywast began technical implementation of an mHealth call center for maternal health in 2013. Responding to a low rate of facility-based deliveries and limited referrals, the call center aims to ensure that all women have the opportunity to deliver at health centers with qualified medical professionals by managing customer relationships between patients and community health workers (CHWs), and facilitating access to emergency medical transportation when necessary. Read more…

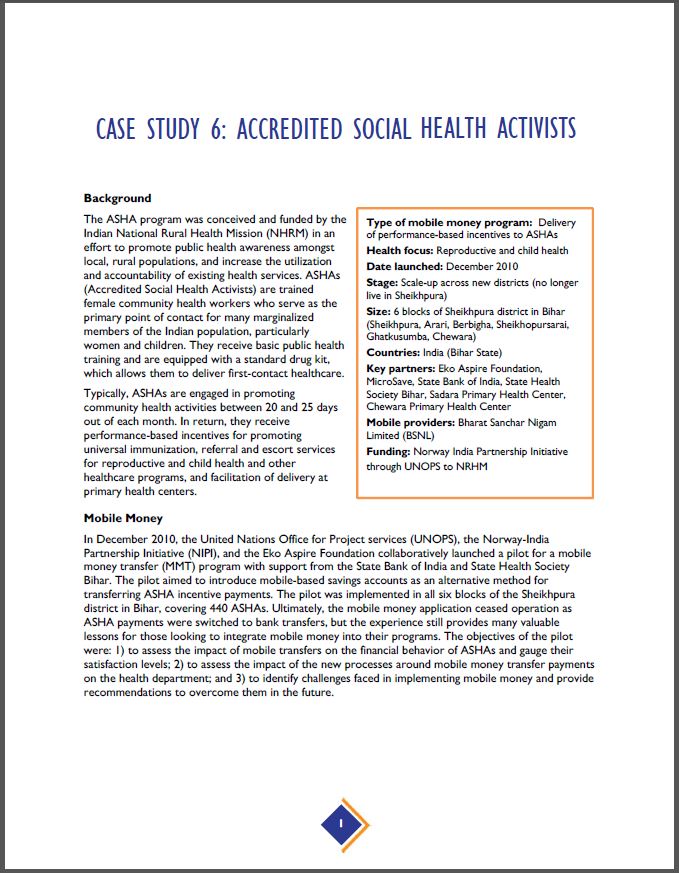

Accredited Social Health Activists (India)

The ASHA program was conceived and funded by the Indian National Rural Health Mission (NHRM) in an effort to promote public health awareness amongst local, rural populations, and increase the utilization and accountability of existing health services. ASHAs (Accredited Social Health Activists) are trained female community health workers who serve as the primary point of contact for many marginalized members of the Indian population, particularly women and children. They receive basic public health training and are equipped with a standard drug kit, which allows them to deliver first-contact healthcare. Typically, ASHAs are engaged in promoting community health activities between 20 and 25 days out of each month. In return, they receive performance-based incentives for promoting universal immunization, referral and escort services for reproductive and child health and other healthcare programs, and facilitation of delivery at primary health centers. Read more…

The ASHA program was conceived and funded by the Indian National Rural Health Mission (NHRM) in an effort to promote public health awareness amongst local, rural populations, and increase the utilization and accountability of existing health services. ASHAs (Accredited Social Health Activists) are trained female community health workers who serve as the primary point of contact for many marginalized members of the Indian population, particularly women and children. They receive basic public health training and are equipped with a standard drug kit, which allows them to deliver first-contact healthcare. Typically, ASHAs are engaged in promoting community health activities between 20 and 25 days out of each month. In return, they receive performance-based incentives for promoting universal immunization, referral and escort services for reproductive and child health and other healthcare programs, and facilitation of delivery at primary health centers. Read more…

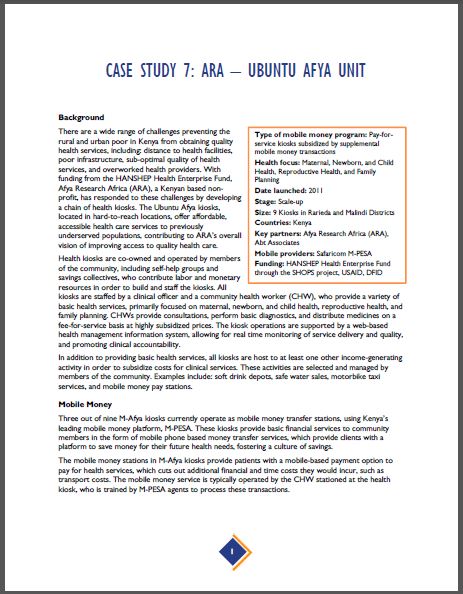

ARA Ubuntu Afya (Kenya)

There are a wide range of challenges preventing the rural and urban poor in Kenya from obtaining quality health services, including: distance to health facilities, poor infrastructure, sub-optimal quality of health services, and overworked health providers. With funding from the HANSHEP Health Enterprise Fund, Afya Research Africa (ARA), a Kenyan based nonprofit, has responded to these challenges by developing a chain of health kiosks. The Ubuntu Afya kiosks, located in hard-to-reach locations, offer affordable, accessible health care services to previously underserved populations. Health kiosks are co-owned and operated by members of the community, including self-help groups and savings collectives, who contribute labor and monetary resources in order to build and staff the kiosks. All kiosks are staffed by a clinical officer and a community health worker (CHW), who provide consultations, perform basic diagnostics, and distribute medicines on a fee-for-service basis at highly subsidized prices. The kiosk operations are supported by a web-based health management information system, allowing for real time monitoring of service delivery and quality, and promoting clinical accountability. Read more…

There are a wide range of challenges preventing the rural and urban poor in Kenya from obtaining quality health services, including: distance to health facilities, poor infrastructure, sub-optimal quality of health services, and overworked health providers. With funding from the HANSHEP Health Enterprise Fund, Afya Research Africa (ARA), a Kenyan based nonprofit, has responded to these challenges by developing a chain of health kiosks. The Ubuntu Afya kiosks, located in hard-to-reach locations, offer affordable, accessible health care services to previously underserved populations. Health kiosks are co-owned and operated by members of the community, including self-help groups and savings collectives, who contribute labor and monetary resources in order to build and staff the kiosks. All kiosks are staffed by a clinical officer and a community health worker (CHW), who provide consultations, perform basic diagnostics, and distribute medicines on a fee-for-service basis at highly subsidized prices. The kiosk operations are supported by a web-based health management information system, allowing for real time monitoring of service delivery and quality, and promoting clinical accountability. Read more…

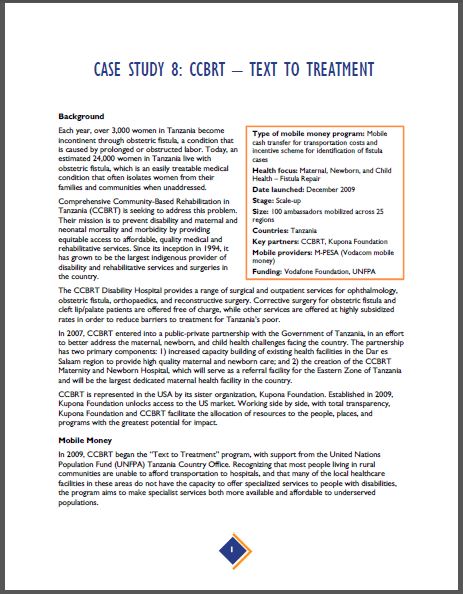

CCBRT – Text to Treatment (Tanzania)

Each year, over 3,000 women in Tanzania become incontinent through obstetric fistula, a condition that is caused by prolonged or obstructed labor. Today, an estimated 24,000 women in Tanzania live with obstetric fistula, which is an easily treatable medical condition that often isolates women from their families and communities when unaddressed. Comprehensive Community-Based Rehabilitation in Tanzania (CCBRT) is seeking to address this problem. Since its inception in 1994, it has grown to be the largest indigenous provider of disability and rehabilitative services and surgeries in the country. In 2009, CCBRT began the “Text to Treatment” program, with support from the United Nations Population Fund (UNFPA) Tanzania Country Office. Recognizing that most people living in rural communities are unable to afford transportation to hospitals, and that many of the local healthcare facilities in these areas do not have the capacity to offer specialized services to people with disabilities, the program aims to make specialist services both more available and affordable to underserved populations. Read more…

Each year, over 3,000 women in Tanzania become incontinent through obstetric fistula, a condition that is caused by prolonged or obstructed labor. Today, an estimated 24,000 women in Tanzania live with obstetric fistula, which is an easily treatable medical condition that often isolates women from their families and communities when unaddressed. Comprehensive Community-Based Rehabilitation in Tanzania (CCBRT) is seeking to address this problem. Since its inception in 1994, it has grown to be the largest indigenous provider of disability and rehabilitative services and surgeries in the country. In 2009, CCBRT began the “Text to Treatment” program, with support from the United Nations Population Fund (UNFPA) Tanzania Country Office. Recognizing that most people living in rural communities are unable to afford transportation to hospitals, and that many of the local healthcare facilities in these areas do not have the capacity to offer specialized services to people with disabilities, the program aims to make specialist services both more available and affordable to underserved populations. Read more…

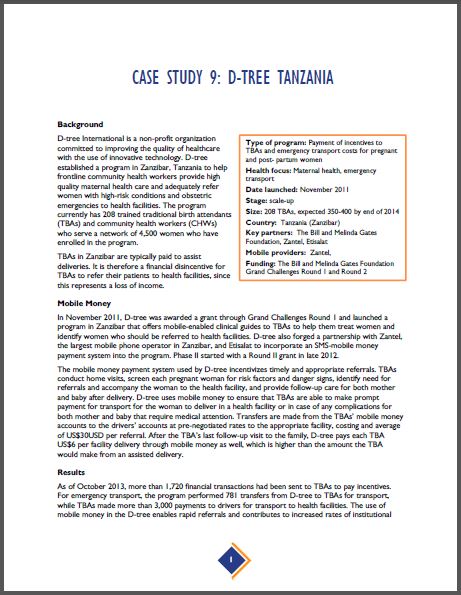

D-Tree Tanzania

D-tree International is a non-profit organization committed to improving the quality of healthcare with the use of innovative technology. D-tree established a program in Zanzibar, Tanzania to help frontline community health workers provide high quality maternal health care and adequately refer women with high-risk conditions and obstetric emergencies to health facilities. The program currently has 208 trained traditional birth attendants (TBAs) and community health workers (CHWs) who serve a network of 4,500 women who have enrolled in the program. In November 2011, D-tree was awarded a grant through Grand Challenges Round 1 and launched a program in Zanzibar that offers mobile-enabled clinical guides to TBAs to help them treat women and identify women who should be referred to health facilities. D-tree also forged a partnership with Zantel, the largest mobile phone operator in Zanzibar, and Etisalat to incorporate an SMS-mobile money payment system into the program. Phase II started with a Round II grant in late 2012. The mobile money payment system used by D-tree incentivizes timely and appropriate referrals. Read more…

D-tree International is a non-profit organization committed to improving the quality of healthcare with the use of innovative technology. D-tree established a program in Zanzibar, Tanzania to help frontline community health workers provide high quality maternal health care and adequately refer women with high-risk conditions and obstetric emergencies to health facilities. The program currently has 208 trained traditional birth attendants (TBAs) and community health workers (CHWs) who serve a network of 4,500 women who have enrolled in the program. In November 2011, D-tree was awarded a grant through Grand Challenges Round 1 and launched a program in Zanzibar that offers mobile-enabled clinical guides to TBAs to help them treat women and identify women who should be referred to health facilities. D-tree also forged a partnership with Zantel, the largest mobile phone operator in Zanzibar, and Etisalat to incorporate an SMS-mobile money payment system into the program. Phase II started with a Round II grant in late 2012. The mobile money payment system used by D-tree incentivizes timely and appropriate referrals. Read more…

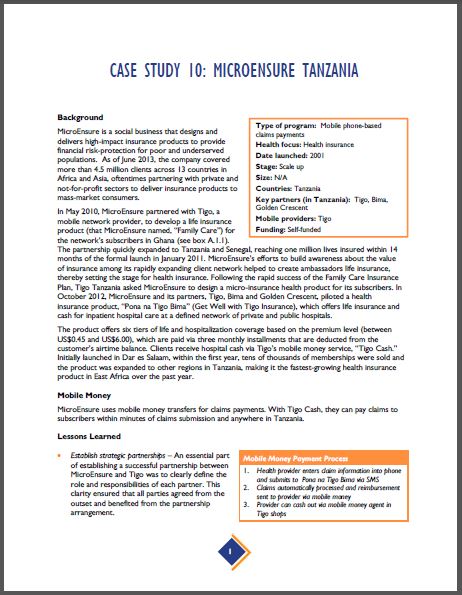

MicroEnsure Tanzania

MicroEnsure is a social business that designs and delivers high-impact insurance products to provide financial risk-protection for poor and underserved populations. As of June 2013, the company covered more than 4.5 million clients across 13 countries in Africa and Asia, oftentimes partnering with private and not-for-profit sectors to deliver insurance products to mass-market consumers. In May 2010, MicroEnsure partnered with Tigo, a mobile network provider, to develop a life insurance product for the network’s subscribers in Ghana. The partnership quickly expanded to Tanzania. MicroEnsure’s efforts to build awareness about the value of insurance among its rapidly expanding client network helped to create ambassadors, thereby setting the stage for health insurance. Initially launched in Dar es Salaam, within the first year, tens of thousands of memberships were sold and the product was expanded to other regions in Tanzania, making it the fastest-growing health insurance product in East Africa over the past year. MicroEnsure uses mobile money transfers for claims payments. With Tigo Cash, they can pay claims to subscribers within minutes of claims submission and anywhere in Tanzania. Read more…

MicroEnsure is a social business that designs and delivers high-impact insurance products to provide financial risk-protection for poor and underserved populations. As of June 2013, the company covered more than 4.5 million clients across 13 countries in Africa and Asia, oftentimes partnering with private and not-for-profit sectors to deliver insurance products to mass-market consumers. In May 2010, MicroEnsure partnered with Tigo, a mobile network provider, to develop a life insurance product for the network’s subscribers in Ghana. The partnership quickly expanded to Tanzania. MicroEnsure’s efforts to build awareness about the value of insurance among its rapidly expanding client network helped to create ambassadors, thereby setting the stage for health insurance. Initially launched in Dar es Salaam, within the first year, tens of thousands of memberships were sold and the product was expanded to other regions in Tanzania, making it the fastest-growing health insurance product in East Africa over the past year. MicroEnsure uses mobile money transfers for claims payments. With Tigo Cash, they can pay claims to subscribers within minutes of claims submission and anywhere in Tanzania. Read more…

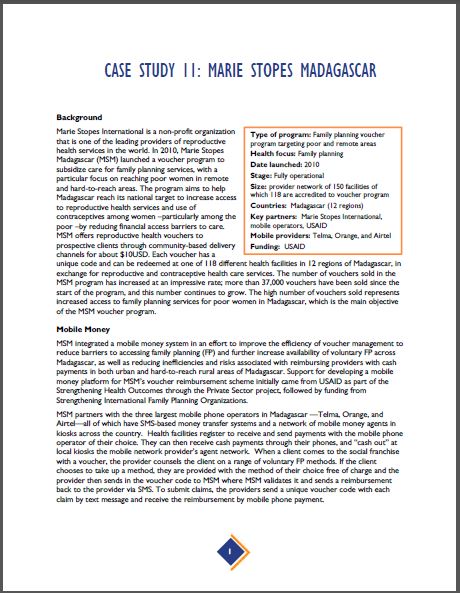

Marie Stopes Madagascar

Marie Stopes International is a non-profit organization that is one of the leading providers of reproductive health services in the world. In 2010, Marie Stopes Madagascar (MSM) launched a voucher program to subsidize care for family planning services, with a particular focus on reaching poor women in remote and hard-to-reach areas. The program aims to help Madagascar reach its national target to increase access to reproductive health services and use of contraceptives among women –particularly among the poor –by reducing financial access barriers to care. MSM offers reproductive health vouchers to prospective clients through community-based delivery channels for about $10USD. MSM integrated a mobile money system in an effort to improve the efficiency of voucher management to reduce barriers to accessing family planning (FP) and further increase availability of voluntary FP across Madagascar, as well as reducing inefficiencies and risks associated with reimbursing providers with cash payments in both urban and hard-to-reach rural areas of Madagascar. Read more…

Marie Stopes International is a non-profit organization that is one of the leading providers of reproductive health services in the world. In 2010, Marie Stopes Madagascar (MSM) launched a voucher program to subsidize care for family planning services, with a particular focus on reaching poor women in remote and hard-to-reach areas. The program aims to help Madagascar reach its national target to increase access to reproductive health services and use of contraceptives among women –particularly among the poor –by reducing financial access barriers to care. MSM offers reproductive health vouchers to prospective clients through community-based delivery channels for about $10USD. MSM integrated a mobile money system in an effort to improve the efficiency of voucher management to reduce barriers to accessing family planning (FP) and further increase availability of voluntary FP across Madagascar, as well as reducing inefficiencies and risks associated with reimbursing providers with cash payments in both urban and hard-to-reach rural areas of Madagascar. Read more…

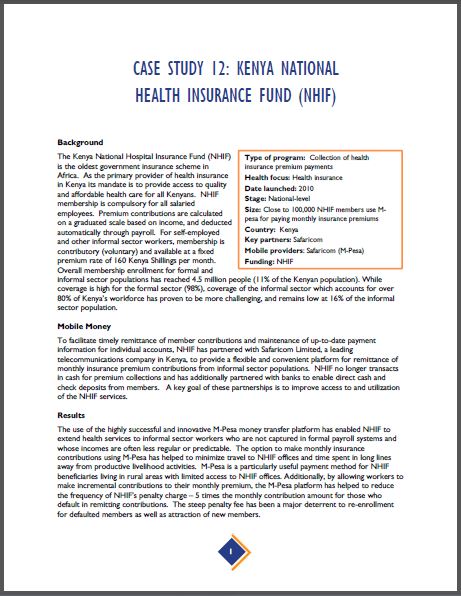

Kenya National Health Insurance Fund (NHIF)

The Kenya National Hospital Insurance Fund (NHIF) is the oldest government insurance scheme in Africa. As the primary provider of health insurance in Kenya its mandate is to provide access to quality and affordable health care for all Kenyans. NHIF membership is compulsory for all salaried employees. Premium contributions are calculated on a graduated scale based on income, and deducted automatically through payroll. Overall membership enrollment for formal and informal sector populations has reached 4.5 million people (11% of the Kenyan population). While coverage is high for the formal sector (98%), coverage of the informal sector which accounts for over 80% of Kenya’s workforce has proven to be more challenging, and remains low at 16% of the informal sector population. To facilitate timely remittance of member contributions and maintenance of up-to-date payment information for individual accounts, NHIF has partnered with Safaricom Limited to provide a flexible and convenient platform for remittance of monthly insurance premium contributions from informal sector populations. Read more…

The Kenya National Hospital Insurance Fund (NHIF) is the oldest government insurance scheme in Africa. As the primary provider of health insurance in Kenya its mandate is to provide access to quality and affordable health care for all Kenyans. NHIF membership is compulsory for all salaried employees. Premium contributions are calculated on a graduated scale based on income, and deducted automatically through payroll. Overall membership enrollment for formal and informal sector populations has reached 4.5 million people (11% of the Kenyan population). While coverage is high for the formal sector (98%), coverage of the informal sector which accounts for over 80% of Kenya’s workforce has proven to be more challenging, and remains low at 16% of the informal sector population. To facilitate timely remittance of member contributions and maintenance of up-to-date payment information for individual accounts, NHIF has partnered with Safaricom Limited to provide a flexible and convenient platform for remittance of monthly insurance premium contributions from informal sector populations. Read more…

L’Union Technique de la Mutualité Malienne

As part of a national commitment to work towards achieving universal health coverage, Mali is scaling-up a network of community based health insurance schemes, otherwise referred to as mutuelles. The mutuelles currently cover 4% of the population. A major challenge faced by the mutuelles is collection and management of membership contributions. The Government of Mali subsidizes 50% of the membership contribution for many members, but even the subsidized premium is expensive for Mali’s poorest. In June 2011, managers of Union Technique de la Mutualité Malienne (UTM) attended a workshop in Mombasa, Kenya, where they learned about the Kenya National Hospital Insurance Fund’s (NHIF) use of M-Pesa, the well-known payment platform, to collect health insurance premiums from informal sector populations. Union Technique de la Mutualité Malienne (UTM) is one of the largest associations of Mutuelle Health Organizations in Mali. UTM worked with Orange Telecommunications to design a mobile money payment system for collecting mutuelle membership contributions. UTM launched the mobile money application within all of Mali’s mutuelles in September 2013. Read more…

As part of a national commitment to work towards achieving universal health coverage, Mali is scaling-up a network of community based health insurance schemes, otherwise referred to as mutuelles. The mutuelles currently cover 4% of the population. A major challenge faced by the mutuelles is collection and management of membership contributions. The Government of Mali subsidizes 50% of the membership contribution for many members, but even the subsidized premium is expensive for Mali’s poorest. In June 2011, managers of Union Technique de la Mutualité Malienne (UTM) attended a workshop in Mombasa, Kenya, where they learned about the Kenya National Hospital Insurance Fund’s (NHIF) use of M-Pesa, the well-known payment platform, to collect health insurance premiums from informal sector populations. Union Technique de la Mutualité Malienne (UTM) is one of the largest associations of Mutuelle Health Organizations in Mali. UTM worked with Orange Telecommunications to design a mobile money payment system for collecting mutuelle membership contributions. UTM launched the mobile money application within all of Mali’s mutuelles in September 2013. Read more…

Movercado (Mozambique)

PSI Mozambique’s Por Ti (For You) health social marketing program uses a mobile technology powered platform to increase healthy behaviors and encourage use of health commodities, such as condoms, water purification and micro-nutrients. Launched in May 2012, the platform known as Movercado is an ecosystem that leverages microentrepreneurs and small businesses to expand access to health commodities to bottom of the pyramid markets. PSI uses a trained cadre of 1440 micro-entrepreneur interpersonal communication agents to conduct outreach sessions that motivate people to change current health behaviors and adopt new ones. The Troka Aki (“Swap here” in Portuguese) brand identifies participating outlets that will redeem Movercado-powered vouchers and accept payments. Troka Aki points include informal neighborhood shops, wholesalers service providers, and pharmacies. Movercado uses mobile money as a component of its larger program and technology platform to send payments safely and securely to shop vendors. Read more…

PSI Mozambique’s Por Ti (For You) health social marketing program uses a mobile technology powered platform to increase healthy behaviors and encourage use of health commodities, such as condoms, water purification and micro-nutrients. Launched in May 2012, the platform known as Movercado is an ecosystem that leverages microentrepreneurs and small businesses to expand access to health commodities to bottom of the pyramid markets. PSI uses a trained cadre of 1440 micro-entrepreneur interpersonal communication agents to conduct outreach sessions that motivate people to change current health behaviors and adopt new ones. The Troka Aki (“Swap here” in Portuguese) brand identifies participating outlets that will redeem Movercado-powered vouchers and accept payments. Troka Aki points include informal neighborhood shops, wholesalers service providers, and pharmacies. Movercado uses mobile money as a component of its larger program and technology platform to send payments safely and securely to shop vendors. Read more…

Program Profiles

D-Tree (Tanzania)

![]() Incentivizing health workers to deliver high quality reproductive, maternal, and neonatal care; removing financial barriers for emergency transportation; improving access to emergency health care for underserved populations.

Incentivizing health workers to deliver high quality reproductive, maternal, and neonatal care; removing financial barriers for emergency transportation; improving access to emergency health care for underserved populations.

Challenge: Transportation costs prevent underserved women from reaching emergency health services in a timely manner.

Solution: In Zanzibar, D-tree International is using mobile money to transfer funds for emergency transportation to traditional birth attendants who identify high risk pregnant women for referrals to health facilities. Read more.

MicroEnsure (Tanzania)

![]() Providing financial protection for health to disadvantaged populations; increasing access to care for priority groups

Providing financial protection for health to disadvantaged populations; increasing access to care for priority groups

Challenge: Delay in receiving claims payments for health insurance can be catastrophic for the poor.

Solution: MicroEnsure partners with a mobile network provider to deliver a health micro-insurance product exclusively to network subscribers. Individuals can receive claims payments via mobile money, ensuring that they rapidly and safely receive reimbursements. Read more.

Marie Stopes (Madagascar)

![]() Increasing use of priority health care; increasing access to care; removing financial barriers to care for underserved and high-priority groups; increasing efficiency and transparency in payments to health providers

Increasing use of priority health care; increasing access to care; removing financial barriers to care for underserved and high-priority groups; increasing efficiency and transparency in payments to health providers

Challenge: Sending claims payments to health providers in rural and remote areas is administratively complicated and costly.

Solution: Marie Stopes Madagascar (MSM) offers vouchers for reproductive health services. Patients exchange the vouchers for health services at select providers, and MSM reimburses the providers via mobile money to ensure timely payments Read more.

National Hospital Insurance Fund (Kenya)

![]() Providing financial protection for health; increasing access to priority health services

Providing financial protection for health; increasing access to priority health services

Challenge: Making monthly health insurance premium payments is inconvenient and time-consuming for members.

Solution: Kenya’s National Hospital Insurance Fund (NHIF) uses the widely recognized M-Pesa payment platform to offer a flexible and convenient mechanism for health insurance premium payments from memberspayments. Read more.

Mutuelles (Mali)

![]() Providing financial protection for health, reducing out-of-pocket expenditure for health, and increasing access to care for poor and underserved populations.

Providing financial protection for health, reducing out-of-pocket expenditure for health, and increasing access to care for poor and underserved populations.

Challenge: Making premium payments in-person is inconvenient for Mali’s mutuelle members residing in rural and hard-to-reach areas, which can deter them from making payments and having financial health protection. For the mutuelles, it is administratively complicated and costly to collect membership contributions in-person, particularly in rural areas.

Solution: Mali’s largest Mutuelle Health Organization (MHO) partnered with a mobile network operator to develop a mobile money application to collect premium payments and manage individual payment records for members. Read more.